VETERAN'S INFORMATION

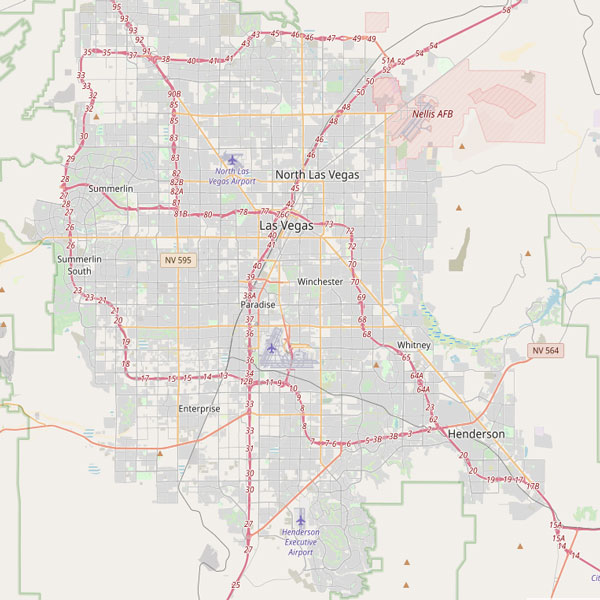

VA Loans for Military Personnel don't have the traditional "limit" of other Government loans. Contact me to find out what you can purchase. If you want to search by zip code, use the map on the right to choose them.

American Legions:

https://post149.org/

https://www.legion.org/

American Legions:

https://post149.org/

https://www.legion.org/

Veteran's Resources

(Valley Medical Services, etc.)

From the VA website:

You must have satisfactory credit, sufficient income, and a valid Certificate of Eligibility (COE) to be eligible for a VA-guaranteed home loan. The home must be for your own personal occupancy. The eligibility requirements to obtain a COE are listed below for Servicemembers and Veterans, spouses, and other eligible beneficiaries.

VA home loans can be used to:

You must have satisfactory credit, sufficient income, and a valid Certificate of Eligibility (COE) to be eligible for a VA-guaranteed home loan. The home must be for your own personal occupancy. The eligibility requirements to obtain a COE are listed below for Servicemembers and Veterans, spouses, and other eligible beneficiaries.

VA home loans can be used to:

- Buy a home, a condominium unit in a VA-approved project

- Build a home

- Simultaneously purchase and improve a home

- Improve a home by installing energy-related features or making energy efficient improvements

- Buy a manufactured home and/or lot

- To refinance an existing VA-guaranteed or direct loan for the purpose of a lower interest rate

- To refinance an existing mortgage loan or other indebtedness secured by a lien of record on a residence owned and occupied by the veteran as a home

Dates of Service for Eligibility:

Service during Wartime:

World War II - September 16, 1940 - July 25, 1947

Korean War - June 27, 1950 - January 31, 1955

Vietnam War - August 5, 1964 - May 7, 1975

Service Requirements:

- At least 90 days active duty - with other than dishonorable discharge

- Less than 90 days active duty - if discharged for a service-connected disability

Gulf War - August 2, 1990 - to be determined

Service Requirements:

- 24 months continuous active-duty - with other than dishonorable discharge

- At least 90 days or completed the full term that he or she was ordered to active duty with other than dishonorable discharge

- At least 90 days active duty - and discharged for hardship, early out, convenience of the Government, reduction in force, condition interfered with duty or compensable service-connected disability

- Less than 90 days active duty - if discharged for a service-connected disability

Service during Peacetime:

All - July 26, 1947 - June 26, 1950 and February 1, 1955 - August 4, 1964

Enlisted - May 8, 1975 - September 7, 1980

Officers - May 8, 1975 - October 16, 1981

Service Requirements:

- At least 181* days continuous active duty - with other than dishonorable discharge

- Less than 181 days active duty - if discharged for a service-connected disability

There are several unique things that make a Veteran's Home Loan different and worth pursuing:

No Down Payment: This may be the most valuable benefit in any subsidized loan program. Conventional and even FHA loans require money down. Even a 3.5 percent down payment on a $200,000 house would equal $7,000.

Relaxed Requirements: Compared to a conventional loan, a VA loan’s credit requirements, which we discussed above, let more applicants through the door.

No PMI: Most loans, including FHA loans, require borrowers to pay private mortgage insurance which protects the lender if you default. With VA backing, a borrower doesn’t need to pay PMI premiums.

Flexible Payback: Unlike most mortgages, a VA loan allows the borrower to pay back the loan in a variety of ways including a graduated structure which has lower payments at the beginning of the term.

Lower Interest Rates: With so many variables we can’t quote reliable interest rates here, but VA loans typically offer rates lower than conventional loans and FHA loans. A lower rate can save you thousands of dollars over the life of a 30-year fixed rate mortgage.

No Down Payment: This may be the most valuable benefit in any subsidized loan program. Conventional and even FHA loans require money down. Even a 3.5 percent down payment on a $200,000 house would equal $7,000.

Relaxed Requirements: Compared to a conventional loan, a VA loan’s credit requirements, which we discussed above, let more applicants through the door.

No PMI: Most loans, including FHA loans, require borrowers to pay private mortgage insurance which protects the lender if you default. With VA backing, a borrower doesn’t need to pay PMI premiums.

Flexible Payback: Unlike most mortgages, a VA loan allows the borrower to pay back the loan in a variety of ways including a graduated structure which has lower payments at the beginning of the term.

Lower Interest Rates: With so many variables we can’t quote reliable interest rates here, but VA loans typically offer rates lower than conventional loans and FHA loans. A lower rate can save you thousands of dollars over the life of a 30-year fixed rate mortgage.